Learn about the Assisted Living Industry and find information on how to open your own Assisted Living facility. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Home Health Care Services Business and Medical Practice Business

Get a free Assisted Living Facility business plan template on our Business Plans page.

Assisted Living COVID-19 Resources

In response to the global COVID-19 pandemic, shelter-in-place orders and physical distancing measures have affected many businesses. Here is a look at the impact to the Assisted Living industry. Assisted living facilities and nursing homes have found themselves as high risk areas for severe cases of COVID-19 due to their communal nature and residents typically being high-risk individuals (older and more likely to have pre-exisiting health conditions). Many states and regulators have begun to issue stricter regulations regarding visitation and record keeping and it is likely that that pressure will continue. Here are additional COVID-19 business resources specific to this industry:

- SBDCNet’s COVID-19 Small Business Resources

- SBDCNet’s COVID-19 Industry Resources

- CDC: COVID-19 Guidelines for Assisted Living Facilities

- Coronavirus Resources – LeadingAge

- Franchise Reopening Blueprint, including Senior Care – International Franchise Association

- Coronavirus Resources for Senior Living

Assisted Living Business Overview & Trends

NAICS Code: 623312; SIC Code: 8322

Assisted Living Facilities will continue to rise in importance as the US population becomes older. The US Census Bureau reports that there are approximately 52.4 million citizens above the age of 65 in the US as of 2018 (most recent data available,) with that number likely to increase as the baby boomer generation begins entering retirement age. The National Center for Assisted Living reports that there are approximately 28,900 assisted living facilities in the US, a number that will need to increase to handle the estimated 95 million people that will comprise that age group by 2060.

This Continuing Care & Assisted Living Facilities summary excerpt is from First Research, which also sells a full version of this report.

- “Companies in this industry provide residential and personal care services for the elderly and others who need or want assistance. Major companies include Brookdale Senior Living, Five Star Senior Living, and Sunrise Senior Living (all based in the US), as well as Housing & Care 21 (UK), Sienna Senior Living (Canada), and Tertianum (Switzerland). The proportion of people aged 60 or older is growing faster than any other age group due to increased life expectancy and lower fertility rates, according to the World Health Organization. Countries with the fastest growing populations include Brazil, China, and India.

- The US continuing care and assisted living facilities industry includes about 25,000 establishments (single location companies and branches of multi-location companies) with combined annual revenue of $63 billion. Companies that provide residential skilled nursing services are covered in a separate profile.

- Competitive Landscape: Demand for continuing care is strong due to rapidly aging senior populations in the US and other developed nations. The profitability of individual facilities depends on efficient operations and positive relations with payers, including families and government and commercial insurers. Large companies have some economies of scale in administration and purchasing. Small operators can compete effectively by offering quality service and attractive amenities, or by operating in a prime location. The US industry is fragmented: the 50 largest companies account for about 30% of revenue.”

Assisted Living Facility Customer Demographics

Major customer segments for Assisted Living Facilities in the US are reported by IBISWorld and can be found here. The full version of the report is available for purchase.

- Customer segmentation is largely focused on age and disability status. Different assisted living facilities handle different levels of complexity of resident care, from basic household tasks to intensive full time nursing staff.

- Seniors aged 65 and older are the main customers of industry services, with the average age of residents at approximately 87 years. Female residents make up more than 75% of this market, owing to existing demographic factors in the US.

- Seniors with disabilities such as Alzhemier’s or mobility problems also compose a large amount of residents: about 21% of people aged 75 to 84 and 50% of age 85 and above require assistance with their daily activities as a result of disabilities.

Additional information on assisted living demographics can be found in a variety of trade associations and publications, including:

Assisted Living Facility Startup Costs

According to Senior Housing News, costs for opening an assisted living facility are best calculated on a price per square foot basis, and the level of service offered to residents should also be considered

“Currently, mid-level assisted living projects range from $176 to $228 per gross square foot, while mid-level independent living projects range from $147 to $185 per gross square foot, according to a recent special issue brief prepared for the American Seniors Housing Association (ASHA) by The Weitz Company’s Amy Burk. High-level assisted living projects, on the other hand, range from $237 to $280 per gross square foot, and high-level independent living projects range from $172 to $231 per gross square foot.”

“Some estimate this amount to be $3,000 to $5,000 per unit after accounting for both resident unit and common space furnishings. Your facility may be more or less based on its size and on both the quantity and quality of the furnishings you provide.”

Assisted Living Facility Business Plans

- Sample Assisted Living Facility Business Plan Template

- Assisted Living Facility Business Plan

- Nursing Home Sample Business Plan

Assisted Living Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant assist living industry associations:

- National Center for Assisted Living

- LeadingAge

- American Association of Retirement Communities

- American Seniors Housing Association

- The Consumer Consortium on Assisted Living

- Center for Excellence in Assisted Living

Assisted Living Business Publications

- Senior Publications Online

- Senior Living Executive Magazine

- Senior Housing News

- McKnight’s Senior Living

Personal Care Aides & Home Health Aides Employment Trends

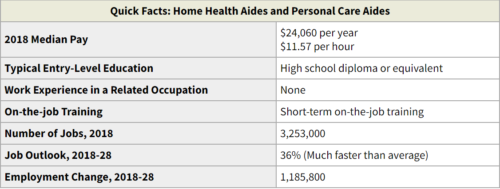

Understanding trends in your industry is important when opening an assisted living facility. Assisted Living Facilities require many different types of employees to stay open depending on services, including housekeeping, medical care, dining staff, and personal care aides. Here is a labor market summary report from the Bureau of Labor statistics focused on Home Health Aides and Personal Care Aides

- “Pay: The median annual wage for home health aides was $24,200 in May 2018.

- Work Environment: Personal care aides held about 2.4 million jobs in 2018. The largest employers of personal care aides were as follows:

Services for the elderly and persons with disabilities – 50%

Home healthcare services – 15%

Residential intellectual and developmental disability facilities – 9%

Continuing care retirement communities and assisted living facilities for the elderly – 7%

Private households – 4% - Job Outlook: Overall employment of home health aides and personal care aides is projected to grow 36 percent from 2018 to 2028, much faster than the average for all occupations. As the baby-boom generation ages and the elderly population grows, the demand for the services of home health aides and personal care aides will continue to increase.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Dominik Lange on Unsplash