Learn about the brewery industry and find more information on how to start a brewery. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Winery Business, Distillery Business, Brewpub Business, and Beverage Industry Research.

Get a free Brewery Business plan template on our Business Plans page.

Brewery COVID-19 Resources

In response to the global COVID-19 pandemic, shelter-in-place orders and physical distancing measures have affected many businesses. Here is a look at the impact to the brewery industry.

As bars and restaurants have closed or limited their operations enforced by government public health regulations and stay at home orders, breweries have experienced a moderate decline in revenue. Despite economic uncertainty, consumer demand remains high as at-home alcoholic beverage sales have increased. However, this growth came at a large decrease of on-premise sales and has mostly gone to larger breweries. Small operators and brewpubs that benefited from on-premise sales took a significant hit as large gatherings became prohibited and stay at home orders shut down dining/tasting rooms. In effort to adapt to changing business operations, brewers have taken to delivering beer locally and adding direct-to-consumer shipping. However, these methods may require assessment of local alcohol laws. Some states have begun reopening breweries for on-premise sales, albeit mostly at limited capacities. Here are additional COVID-19 business resources specific to this industry:

- SBDCNet’s COVID-19 Small Business Resources

- Brewers Association Coronavirus Resource Center

- Master Brewers Association COVID-19 Resources

- Beer Institute COVID-19 Resources

Brewery Business Overview & Trends

NAICS Code: 312120, SIC Code: 2082

The small and independent brewery market is a significant player in the beer production industry, with retail sales estimated at $29.3 billion dollars. This is approximately 25% of the $116.0 billion U.S. beer market in 2019, which includes the larger domestic beer producers such as Anheuser-Busch Inc, Molson Coors, and the like.

This Brewery industry summary is from First Research, which also sells a full version of this report.

- “Companies in this industry produce beer, ale, malt liquor, and nonalcoholic beer. Major companies include Anheuser-Busch InBev (Belgium), Asahi Breweries (Japan), Carlsberg (Denmark), China Resources (China), Heineken (the Netherlands), Molson Coors (US), and Tsingtao (China). DG Yuengling and Son is the leading US craft brewer by sales volume, according to the Brewers Association. Worldwide, breweries produce about 2 billion hectoliters of beer annually, according to Kirin Beer University. The largest beer-producing nations include China, the US, Brazil, Mexico, and Germany. Developing markets in Asia, Latin America, and Africa are being targeted for industry growth.

- The US brewery industry includes about 2,800 establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $32 billion. Counting brewpubs and microbreweries, the US industry includes about 7,500 establishments.

- Competitive Landscape: Large breweries dominate the global beer market, but smaller craft breweries have gained market share in recent years by introducing a variety of new products that sell at higher price points. Some major beer makers have acquired popular craft brands to limit competition from the fast-growing sector. Small producers in some markets have also benefited from regulatory changes that have made it easier to self-distribute directly to retailers without having to sell through wholesalers. Breweries compete with distilleries, wineries, and other manufacturers of alcoholic and nonalcoholic beverages.”

This Beer in the US market research report summary is from Euromonitor, which also sells a full version of this report.

- Due to various shutdowns as a result of the COVID-19 pandemic, Euromonitor foresees overall beer sales in the US declining sharply in 2020 contributing to a negative total growth rate of 2% over the forecast period of 2019-2024

- Light beers are struggling to compete with rising popularity of emerging hard seltzers for consumers drawn towards low-calorie, low-carb alcoholic beverages. As consumers became increasingly interested in health and wellness trends, the non-alcoholic beer category enjoyed strong growth in 2019, primarily led by smaller craft breweries.

- Small craft brewers will be hardest hit by COVID-19 impacts, as they are highly reliant on on-premises transactions and foot traffic. Craft beer also skews towards premium pricing, which does not perform as well with cost-conscious consumers during a period of economic downturn.

Additional resources on brewery industry overview and trends:

- Brewers Association Annual Growth Report

- Competitive Landscape for Craft Beer Market

- Craft Beer Trends in 2020

Craft Beer and Breweries Customer Demographics

Major customer segments for Breweries and Craft Beer Production are reported by IBISWorld, which offers full versions of the reports for purchase here and here.

- The key markets for breweries in 2020 consist of restaurants and bars (33.8%), clubs and event spaces (15.4%), convenience stores (14.1%), supermarkets, grocery stores, and drug stores (12.9%), liquor stores (10.9%), exports and other (12.9%).

- Off-premise markets typically account for a larger share of total sales volume, while on-premise markets historically generate more revenue. For small operators, persuading local retail businesses to carry their products helps boost brand awareness. Due to the coronavirus pandemic, overall sales volumes are expected to decline, and off-premise consumer purchases will gain traction over on-premise purchases.

- Over the past five years, the largest market segment for craft beer has been college students and young professionals aged 21 to 34, responsible for 38.9% of industry revenue. Middle-aged consumers (ages 35 to 54) represent a stable share of industry revenue (21.8%), although this older demographic gravitates more toward wine and spirits than the younger demographic. Consumers aged 55 and older form a shrinking customer segment responsible for just 19.5% of industry revenue, as they strongly prefer other alcoholic beverages and premium beer brands from large domestic beer manufacturers over craft beer.

Additional information on craft beer customers can be found in a variety of topical and trade publications, including:

Brewery Business Startup Costs

According to Business News Daily, the average cost to start a brewery is estimated to be in the range of $500,000 to $1,000,000. The wide range comes from the varying difficulty of state and local permits and regulations as well as whether a brewery has an on-premise tasting component.

Additional brewery startup costs information can be found through the following resources:

- How to Open a Brewpub or Microbrewery

- Brew Pub Business – Entrepreneur Magazine:

- How Much Does It Cost to Start a Brewery?

Brewery Business Plans

- Brewing Company Business Plan

- Microbrewery Business Plan

- Business Plan Resources for Breweries

- How to Make a Brewery Business Plan

Brewery Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant brewery industry associations:

- American Homebrewers Association

- Beer Institute

- Brewers Association

- Craft Brewing Business

- Master Brewers Association of the Americas

Brewery Business Regulations

The section is created to provide a general awareness of regulations and agencies to consider when starting a Brewery Business. Check with your state and municipality for rules and regulations that may impact the business in your area. The alcoholic beverage industry is among the most regulated, with most regulations coming from the state level. Check with your local alcoholic beverage commission, control board, or regulatory agency for resources specific to your state and type of business

- Alcohol and Tobacco Tax and Trade Bureau

- Alcohol Tobacco Tax and Trade Bureau – Beer Laws, Regulations, and Public Guidance

- Brewers Association – Brewery Sales and Sampling Laws

- American Homebrewers Association – Statutes

- Control State Directory and Info

- Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF): Code of Federal Regulations

Beer Industry Publications

Brewery Business Employment Trends

The Brewer’s Association reports on the size of the small and independent brewery workforce:

- 160,000 direct jobs at breweries and brewpubs.

- 580,000 total indirect jobs including industries supplying and supplied by small breweries

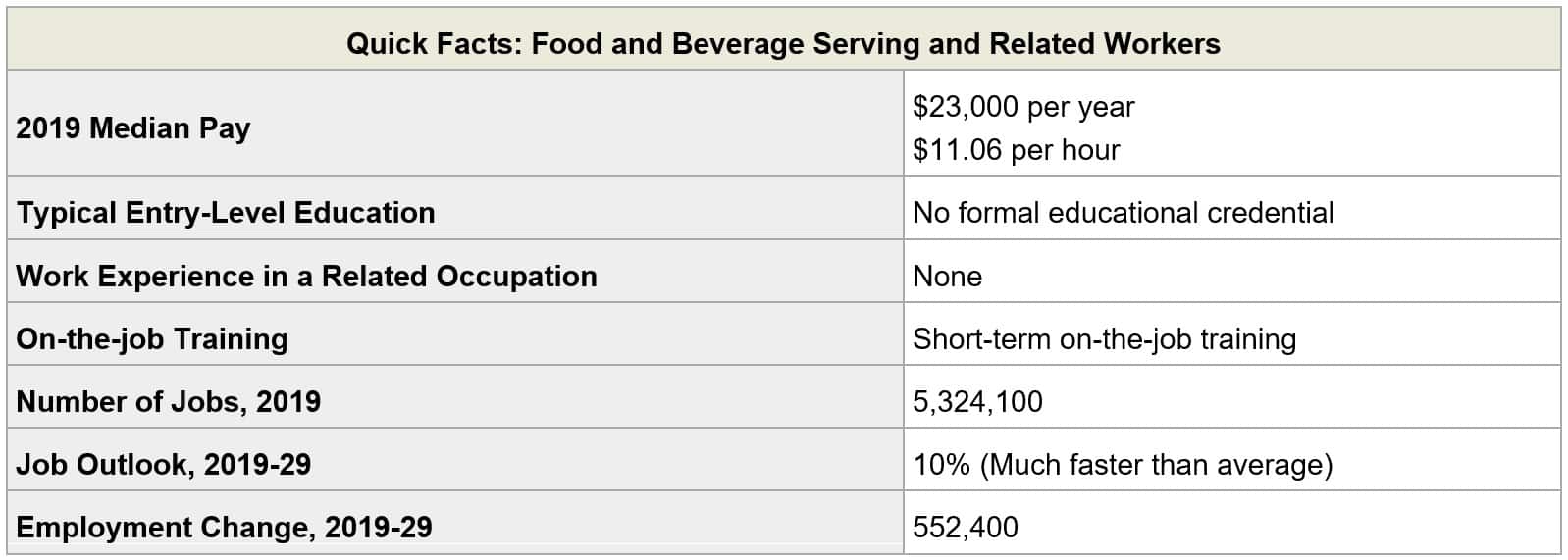

Brewery employment encompasses various jobs. One of the major occupational groups in the brewery industry is food and beverage serving workers. This may be because many microbreweries sell on-premise in addition to distributing to other sectors. A more specific breakdown of other brewery occupations is available from the Bureau of Labor Statistics.

- “Work Environment: Food and beverage serving and related workers held about 5.3 million jobs in 2019… Food and beverage serving and related workers spend most of the time on their feet and often carry heavy trays of food, dishes, and glassware. During busy dining periods, they are under pressure to serve customers quickly and efficiently. ‘Food preparation and serving related workers, all other,’ in particular, have one of the highest rates of injuries and illnesses of all occupations… Common hazards include slips, cuts, and burns, but the injuries are seldom serious. To reduce these risks, workers often wear gloves, aprons, or nonslip shoes. Many food and beverage serving and related workers are employed part time. Because food service and drinking establishments typically have extended dining hours, early morning, late evening, weekend, and holidays work is common.

- Job Outlook: Overall employment of food and beverage serving and related workers is projected to grow 10 percent from 2019 to 2029, much faster than the average for all occupations. As a growing population continues to dine out, purchase take-out meals, or have food delivered, more restaurants, particularly fast-food and casual dining restaurants, are expected to open. In response, more food and beverage serving workers, including fast-food workers, will be required to serve customers… Job prospects for food and beverage serving and related workers will be excellent because many workers leave the occupation each year, resulting in a large number of job openings.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Alexander Kovacs on Unsplash