Learn about the Gym Business industry and find information on how to start a Fitness Center or Gym. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

For additional information about the Sports and Fitness Industry, see our Market Research Links here.

Get a free Fitness Center/Gym Business plan template on our Business Plans page.

Fitness Center/Gym Business COVID-19 Resources

In response to the global COVID-19 pandemic, shelter-in-place orders and physical distancing measures have affected many businesses. Here is a look at the impact to the Fitness Center/Gym industry.

Fitness Centers and Gyms are expected to have a drastic decrease in revenue due to being closed down for public health reasons. To combat this loss of in person revenue, some operators began making online or virtual training available. In addition, high job losses across the nation have led to many gym memberships being cancelled or customers requesting refunds. Here are additional COVID-19 business resources specific to this industry

- SBDCNet COVID-19 Small Business Resources

- IHRSA – Coronavirus Resources for Health Clubs

- Club Industry’s Coronavirus Resource Page For Fitness Industry Professionals

- COVID-19 Employer Information for Gyms and Fitness Centers | CDC

- The Impact of COVID-19 On Fitness Studios & Gyms

- COVID-19 Gym & Fitness Impact Report

Fitness Center/Gym Business Overview & Trends

NAICS Code: 713940, SIC Code: 7991

Fitness Centers and Gyms are an important segment of the U.S. Fitness industry with a significant impact on the U.S. economy. Statista reports that revenue in the Fitness segment totals $5,325 million in 2020.

While health clubs make up only a segment of the sports and fitness industry, the International Health, Racquet & Sportsclub Association (IHRSA) reports that in the U.S. in 2018, more than 71.5 million consumers utilized health clubs with individual membership at 62.5 million, up 2.6% from 2017. The IHRSA study reveals that the U.S. health club industry revenue grew 7.8% to $32.3 billion.

This Fitness Centers industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry operate fitness and recreational sports facilities that offer fitness equipment, exercise classes, swimming pools, and fitness instruction services. Major companies include LA Fitness, 24 Hour Fitness, Equinox, Gold’s Gym, Planet Fitness, Life Time Fitness, and Town Sports International (all based in the US), along with Fitness First and Virgin Active (both based in the UK), Konami Sports Club (Japan), and McFit (Germany). Worldwide, fitness centers generate about $95 billion in annual revenue, according to the International Health, Racquet & Sportsclub Association (IHRSA). More than 210,000 fitness clubs across the globe attract about 183 million members. The top three markets by revenue are the US, Germany, and the UK.

- The US industry includes about 36,500 fitness and recreation center establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $33 billion.

- Competitive Landscape: Demand is partly linked to income levels and partly to market demographics. The profitability of individual companies depends on good marketing. Large companies have economies of scale in advertising and in buying equipment. Small companies can compete effectively if they have favorable locations or meet customer demands for personalized service and friendly atmosphere. The industry is fragmented in the US: the 50 largest companies account for about a third of revenue.”

Additional resources on Fitness Center/Gym Industry:

- 2019 Fitness Industry Trends Shed Light on 2020 & Beyond – IHRSA

- Fitness Studio Industry Fact Sheet

- 10 Gym Membership Statistics

- 60 Stats and Trends to Grow Your Fitness Business in 2020

Fitness Center/Gym Customer Demographics

14% of the US population hold a gym membership. According to CDC, 53.3% of adults engage in any exercise activities such as walking or jogging and 23.2% are involved with both exercises and muscle strengthening activity. 28% of Americans aged 6 and older are physically inactive.

Major customer segments for Gym, Health, and Fitness Clubs are reported by IBISWorld, which offers a full version of the report for purchase here.

- Consumers below the age of 35 make up 48.7% of gym revenue. This group of customers is usually the most active and interested in gym memberships. They have a wide range of interest in classes and memberships and do not particularly gravitate to any one type.

- Consumers between the ages of 35 to 50 make up 26.5% of revenue. This industry sector has stagnated over the past few years as operators focused their services and marketing on younger customers

- Consumers over the age of 50 make up the remaining 24.8% of industry revenue. This group has a high participation rate in physical activity as people maintain active lifestyles after retirement. With this age group continuing to grow in the US, operators who make senior-friendly classes and offerings can tap into this large market segment.

Additional information on fitness center/gym customers can be found in a variety of topical and trade publications, including:

- Fitness & Gym Membership Statistics for 2020

- Target Market for Fitness Gyms

- Gym Membership Statistics

Fitness Center/Gym Business Startup Costs

According to a survey conducted by Sage Accounting, the average fitness center and gym startup costs vary depending on the equipment required and amenities. The estimated cost to open a gym according to their survey is as follows:

- Modest studio gym: $65,000

- Mid-size gym: $115,000

- Simple cycling studio: $50,000

- Costs can vary drastically

- Bottom line: startup costs range from $50,000 for a budget facility to over $1,000,000 for a mega-gym with all the amenities

Many fitness centers/gyms are part of a franchise. This will have a large impact on your startup costs as the franchisor will likely have certain amounts of equipment/investments required to open. Contact your prospective franchisor or view their website for details. For more information on franchise businesses, see our Franchise Small Business Help Topic.

The following resources have additional fitness center/gym business startup costs information:

- Fitness Center Business Startup Costs

- Cost to Open a Gym & Fitness Center

- How to Start My Own Gym Business – Chron

- Gym Equipment Needed for a Fitness Studio

Fitness Center/Gym Business Plans

- Workout Gym Business Plan

- Fitness Center Business Plan

- Fitness Center and Gym Business Plan

- Business Plan Template for Fitness Business Owners

- 5 Key Elements of a Fitness Studio Business Plan

Fitness Center Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant Fitness Center and Gym associations:

- International Health, Racquet & Sportsclub Association (IHRSA)

- Club Industry

- American Council on Exercise (ACE)

- Association of Fitness Studios (AFS)

- National Association for Health and Fitness (NAHF)

- Medical Fitness Association

Fitness Center/Gym Business Regulations

The section provides a general awareness of fitness center/gym regulations and agencies to consider when starting a Fitness Center/Gym Business. Check with your state and municipality for rules and regulations that may impact the business in your area.

The state in which your business is located likely has regulations regarding gym membership contracts and rules on how liability resulting from on-site injuries is handled.

Fitness Center/Gym Business Publications

- Muscle & Fitness

- Club Solutions Magazine

- National Fitness Trade Journal

- Experience Life – Fitness

- Top 10 Fitness Magazines

Fitness Business Employment Trends

The US Census Bureau reports on the size of Fitness and Recreational Sports Centers and number of employees (NAICS 713940):

- Approximately 37,758 establishments in the US

- 757,408 total employees across the nation

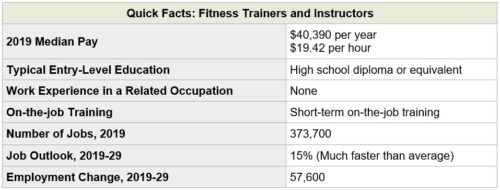

Labor costs are important factors for Fitness Center and Gym business owners. Here is the Fitness Trainers and Instructors labor market summary from the Bureau of Labor Statistics. A more specific breakdown of other fitness and recreational sports centers occupations is available from the Bureau of Labor Statistics.

- “Work Environment: Fitness trainers and instructors held about 373,700 jobs in 2019… Fitness trainers and instructors may work in standalone fitness centers or centers maintained by other types of establishments for their employees or for members of civic and social organizations. Some work in clients’ homes.

- Job Outlook: Employment of fitness trainers and instructors is projected to grow 15 percent from 2019 to 2029, much faster than the average for all occupations. As businesses, government, and insurance organizations continue to recognize the benefits of health and fitness programs for their employees, incentives to join gyms or other types of health clubs are expected to increase the need for fitness trainers and instructors. For example, some organizations may open their own exercise facilities onsite to promote employee wellness. Other employment growth will come from the continuing emphasis on exercise to combat obesity and encourage healthier lifestyles for people of all ages. In particular, the baby-boom generation should continue to remain active to help prevent injuries and illnesses associated with aging. Participation in yoga and Pilates is expected to continue to increase, driven partly by older adults who want low-impact forms of exercise and relief from arthritis and other ailments.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!