Learn more about the Coffee Shop industry, and where to find more information about how to open your own Coffee Shop business. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

Get a free Coffee Shop business plan template on our Business Plans page.

Coffee Shop Business Pandemic Impact & Recovery

The COVID-19 pandemic, shutdown orders impacted many food service businesses. Here is a look at the impact to the Coffee Shop Business industry.

Despite the decline in coffee shops at the start of the pandemic, those that found innovative ways to adapt to the new operational realities allowed them to remain in service. In response to the shutdown orders, many coffee shops remained open on a limited basis closing cafes and shifting their service to drive-through lanes. With stay-at-home order lifting, many coffee shops resumed in-person service and saw a partial return of the customer. Stay-at-home orders shifted the workforce home, and with-it morning-commute consumers. Although single-serve coffee makers came on the market in the 1990s, they enjoyed a remarkable market share growth in the United States before the start of the pandemic with 40% of consumers reporting owning one in 2020.

A critical element of coffee shops is its own workforce, labor shortages is a prominent issue across industries and even more so to food service industries. Staff calling out sick or not being able to fill positions once shelter-in-place orders started lifting, caused service disruption to coffee shops and resulted in temporary or permanent shut downs. Although time has passed since COVID-19 emerged, the virus continues as a constant in society with the emergence of new variants. As a result, coffee shops should continue to adapt to overcome the challenges they face. Retaining the more successful strategies allowed many coffee shops to keep a competitive advantage and thrive.

- SBDCNet COVID-19 Small Business Resources

- SBDCNet Small Business Reopening Guide

- National Coffee Association Covid-19 Resource Center

- Specialty Coffee Association COVID-19 Resource Database

Coffee Shop Business Overview & Trends

NAICS Code: 722515, SIC Code: 5812

This Coffee Shop industry summary is from First Research, which also sells a full version of this report.

- “Companies in this industry sell coffee drinks and other food and beverages for consumption on the premises or for takeout. Major companies include Peet’s Coffee, Starbucks, and The Coffee Bean & Tea Leaf (all based in the US), as well as Caffè Nero and Costa Coffee (both based in the UK).

- The biggest US coffee chains operate stores abroad, primarily through licensing agreements. Starbucks owns and licenses about 32,000 locations worldwide. The world’s largest coffee consumers include Finland, Norway. And Iceland among other countries, according to the World Population Review.

- The US coffee shop industry includes more than 60,000 stores with combined annual sales of about $40 billion. Coffee shops are part of the specialty eatery industry, which also includes outlets specializing in products such as bagels, donuts, frozen yogurt, and ice cream.

- Competitive Landscape: Consumer taste and personal income drive demand. The profitability of individual companies depends on the ability to secure prime locations, drive store traffic, and deliver high-quality products. Large companies have advantages in purchasing, finance, and marketing. Small companies can compete effectively by offering specialized products, serving a local market, or providing superior customer service. Coffee shops compete with businesses such as convenience stores, gas stations, quick-service and fast-food restaurants, gourmet food shops, and donut shops. The US industry is fragmented: the eight largest companies account for about 30% of revenue.”

The following Coffee business market research summary is from Euromonitor, which also sells a full version of this report.

The ongoing return of Americans to the office is prompting consumers return to coffee shops; however, inflationary pressures impact on discretionary spending along with the fluctuating change in fuel prices are having a cyclical impact on people making a drive to the coffee shop. Euromonitor also reports on the increase popularity of cold coffee, which includes a year-round demand for iced-coffee, cold brew and other cold formats. Given the global sourcing of coffee beans, this industry is also susceptible to the impact of supply chain issues and climate change.

The following are select key findings reported in the Trends & Reports from the National Coffee Association, which also sells a full versions of this report.

COVID Adaptation

The adaptation strategies of coffee shops as they pivoted when the pandemic first emerged seem to be here to stay. The most notable adaptations that appealed the most to consumers are the use of apps for ordering and drive-through service.

Demographics

While consumption among younger consumers (ages 18-24) is less than their older counterparts, unchanged is their preference in coffee with this group choosing specialty coffees over a traditional brew by their older aged cohorts.

Coffee at Home

With many consumers buying coffee machines for their home, 27% of respondents tried to replicate their coffee shop experience. Industry adaptation can be seen as many branded coffee shops sell their signature brews as ground coffee and single-serve pods through online and brick-and-mortar retailers.

Coffee Shop Business Customer Demographics

IBISWorld reports on the major market segments for Coffee & Snack Shops in the US. The full version of the report is available for purchase.

- The Coffee & Snack Shops industry generates approximately $54.5 billion with the majority of establishments generating revenue from households

- The major markets are segmented by household earnings in the following order:

- $150,000 + (38.9%)

- $30,000-$69,999 (20.7%)

- $100,000-$149,999 (13.6%)

- $70,000-$99,999 (9.5%)

- Earning Less Than $30,000 (8.8%)

- Businesses (8.5%)

Coffee Shop Business Startup Costs

Cost to Open a Coffee Shop from Toast:

- The average cost to open a single coffee shop with seating is between $80,000-$300,000.

- The cost of opening a coffee food truck or kiosk is on the lower end (closer to $60,000 for the minimum possible cost), and including both seating and drive-through coffee is higher and can reach the $300,000+ range.

The Total Cost to Open a Coffee Shop from CrimsonCup:

- Coffee shop with seating only: $80,000 to $325,000

- Coffee shop with a drive-through only: $80,000 to $225,000.

- Coffee shop with both seating and a drive-through: $80,000 to $350,000

- Coffee kiosk/coffee stand/mobile coffee cart: $60,000 to $120,000

- Mobile coffee food truck: $50,000 to $155,00

- Adding a brew bar to an existing coffee shop: $1,500 to $25,000. The lower price is for buying equipment only.

- Adding specialty coffee service to a bakery or cafe: $25,000 to $75,000

How to Run Your Own Coffee Shop from Investopedia:

- A sit-down coffee shop typically costs between $80,000 and $275,000 to set up.

- A large drive-through shop can cost between $80,000 and $200,000.

- A small kiosk may cost between $60,000 and $100,000.

- A franchised sit-down coffee shop can cost up to $650,000.

- A licensed brand-name store may cost $315,000 to open.

Coffee Shop Business Plans

- Coffee Shop Business Plan – Bplans

- How to Write a Coffee Shops Business Plan – Toast

- Coffee Shops Business Plan – CrimsonCup

- Gourmet Coffee Shop Business Plan – The Finance Resource

- Coffee Shop Business Plan – Profitable Venture

Coffee Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant industry associations:

- National Coffee Association

- Specialty Coffee Association of America

- Coffee Roasters Guild

- Green Coffee Association

- International Coffee Organization

Coffee-Related Business Regulations

At the federal-level, the U.S. Food & Drug Administration provides guidance on starting a food-related business. Additionally, there are national employee regulations setting the minimum wage and the benchmark at which employers are required by the Affordable Care Act to provide their employees access to healthcare. The majority of regulations for the food service industry are set at the state and local-level. Provided below are some national regulations and standards

- National Coffee Association – Issues and Regulations

- National Coffee Association – Regulatory Developments

- U.S. Food & Drug Administration – State Retail and Food Service Codes and Regulations by State

- Fairtrade International – Fairtrade Standard for Coffee

- Toast – 10 Permits and Licenses Needed To Open A Coffee Shop

Coffee Business Publications

- Fresh Cup Magazine

- Daily Coffee News by Roast Magazine

- Caffeine

- Barista Magazine Online

- Beverage Industry

- Bon Appetit

Coffee Shop Business Employment Trends

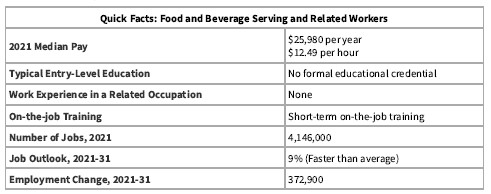

Here is the Food and Beverage Serving labor market summary from the Bureau of Labor Statistics.

“Pay: The median hourly wage for food and beverage serving and related workers was $12.49 in May 2021. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $8.80, and the highest 10 percent earned more than $16.40.”

“Work Environment: Food and beverage serving and related workers are employed in restaurants, schools, and other dining places. Work shifts often include early mornings, late evenings, weekends, and holidays. Part-time work is common.”

“Job Outlook: Overall employment of food and beverage serving and related workers is projected to grow 9 percent from 2021 to 2031, faster than the average for all occupations. About 955,100 openings for food and beverage serving and related workers are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View our business reports here: Small Business Snapshots

- View our small business help topics here: Small Business Information Center

- View our industry-specific research here: Market Research Links

- View our small business cybersecurity resources here: Cybersecurity

- View our pandemic business resources here: COVID-19 Publications

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!